Cost Segregation

Where Engineering and Accounting Come Together

Under the IRS guidelines for Cost Segregation Studies (“CSS”), property owners have the opportunity to realize significant tax benefits from accelerated depreciation supported by Treasury regulations. Quantum Engineering Associates, Inc. (“QEA”) has been working with property owners and CPA firms throughout the U.S.to provide the most thorough Cost Segregation Studies utilizing a detailed engineering approach from actual cost records in accordance with the IRS Audit Technique Guidelines. QEA’s cost segregation staff includes a unique blend of licensed engineers and architectural professionals, who are able to skillfully identify and re-classify building components from real to personal property thereby maximizing the depreciation deductions available and directly increasing the related tax benefits for an owner of investment real estate.

The Cost Segregation Benefit

By recovering costs over a shorter period of time, property owners will realize substantial tax savings. A CSS allocates total building costs between real property (27.5-39 year life) and personal property (5-15 year life). This reallocation of costs from real to personal property typically amounts to a 25-40% benefit over the traditional depreciation method.

CSS Benefit Example

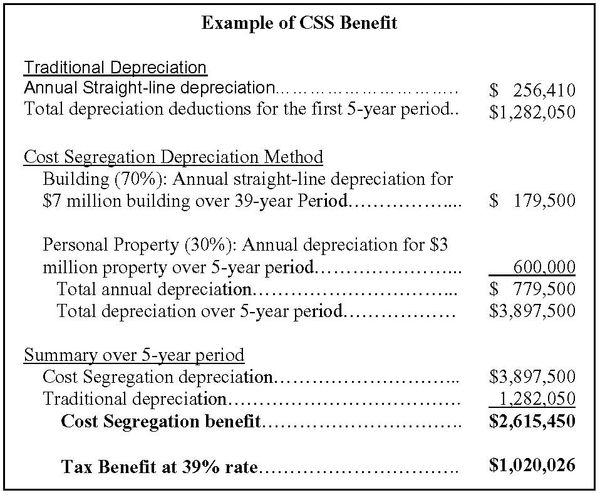

This example illustrates the benefits of depreciation using cost segregation instead of the traditional (and much more costly) method assuming a building cost of $10 million with straight-line depreciation over 39 years. It assumes that CSS has established a 70/30% allocation between real property (39-year life) and personal property (5-year life).

Assuming a 39% federal tax rate using the CSS alternative method, the property owner would have reduced taxable income by an additional $2,615,450 for a cash savings $1,020,026. In the event that the building was placed into service in prior years a taxpayer can amend prior years returns for a refund, or can take a section 481(a)catch up to reduce taxable income in the year of the CSS.

CSS Questionaire

Please include this questionnaire with all CSS inquiries.

Copyright © 2023 Quantum Engineering Associates, Inc - All Rights Reserved.

Powered by GoDaddy

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.